8 5: Describe How Companies Use Variance Analysis Business LibreTexts

Note that unfavorable variances (negative) offset favorable (positive) variances. A total variance could be zero, resulting from favorable pricing that was wiped out by waste. A good manager would want to take corrective action, but would be unaware of the problem based on an overall budget versus actual comparison. An unfavorable labor quantity variance occurred because the actual hours worked to make the \(10,000\) units were greater than the expected hours to make that many units. Dan observes a substantial labor variance in one of the production divisions.

Labor Variance

The completed top section of the template contains all the numbers needed to compute the direct materials quantity and price variances. The direct materials quantity and price variances are used to determine if the overall variance is a quantity issue, price issue, or both. Direct Material Usage Variance measure how efficiently the entity’s direct materials are using. This variance compares the standard quantity or budget quantity with the actual quantity of direct material at the standard price.

Standard Costing Advantages Explained

Analyzing this unfavorable variance can help the company identify cost-saving techniques. It allows management to make decisions and take corrective actions if necessary. It entails evaluating outcomes in light of prior performance data, industry benchmarks, and best practices to thoroughly assess a company’s success. It can identify areas for improvement or excellence at several levels, including projects, divisions, product lines, or the entire organization. Budgets are the result of planning efforts to estimate a company’s performance for a period of time in the future.

Direct materials price variance

Further research reveals that the labor hours were less than standard hours. Dan examines the causes of this variation to see if there was an increase in breaks taken or if there were production process inefficiencies. Based on his findings, Dan recommends changes across certain strategies, including labor scheduling, process enhancements, and cost-cutting techniques, to resolve the variance and boost overall effectiveness. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to better understand the variable overhead efficiency reduction. Kitchen Co. is experiencing production problems with SuddyBuddy, its most profitable product. Management has requested standard cost variances in order to isolate the issue.

The total direct labor variance was favorable $8,600 ($183,600 vs. $175,000). However, detailed variance analysis is necessary to fully assess the nature of the labor variance. As will be shown, Blue Rail experienced a very favorable labor rate variance, but this was offset by significant unfavorable labor efficiency.

What is Standard Costing?

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint irs down current problems and outages presentations, accounting and business strategy. A cost formula is used to predict the expected cost for a specific expenditure. You’ve put in the time calculating, analyzing, and explaining your variances.

- It helps them find trends, budget better, monitor finances, control costs, and make good choices.

- Companies can set goals, recognize top performers, and motivate people and teams to work harder for better outcomes.

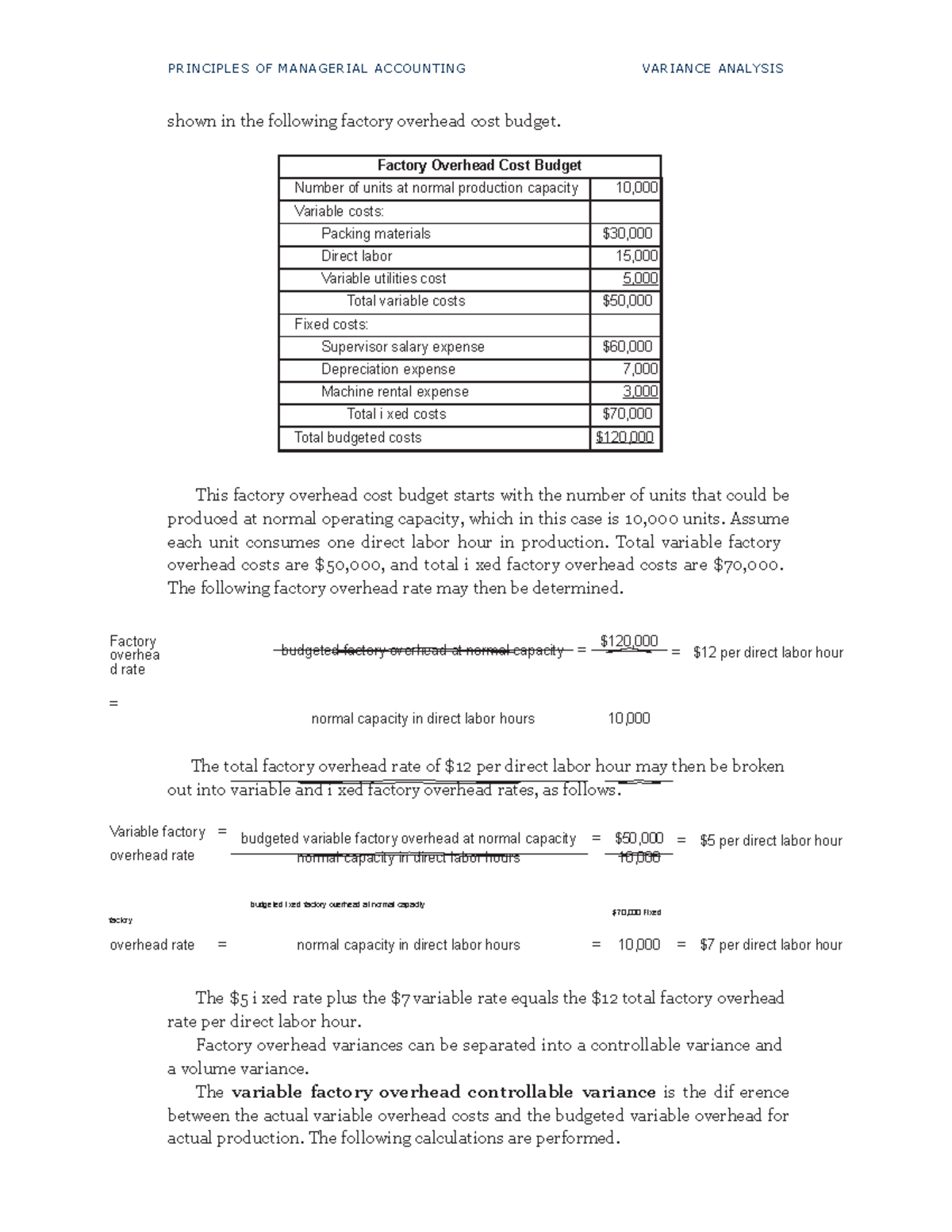

- In a standard cost system, overhead is applied to the goods based on a standard overhead rate.

- At the highest level, standard costs variance analysis compares the standard costs and quantities projected with the amounts actually incurred.

- The fixed component of manufacturing overhead is comprised of overhead costs that stay the same in total regardless of the quantity produced or another cost driver.

- Based on his findings, Dan recommends changes across certain strategies, including labor scheduling, process enhancements, and cost-cutting techniques, to resolve the variance and boost overall effectiveness.

Manufacturing overhead is typically a mixed cost consisting of a variable and a fixed component. Fixed manufacturing overhead is, by definition, fixed and should not change as long as production remains within the relevant range. The total amount of variable manufacturing overhead changes based on production so it has a quantity and price standard. Since direct material, direct labor, and variable manufacturing overhead have quantity and price standards, they are analyzed using the standard costs variance analysis method presented in this chapter. Standard costs and quantities are established for each type of direct labor.

Using cost variance analysis withactivity-based costing is much like using cost variance analysiswith traditional costing. However, activity-based costing requirescalculating a spending and efficiency variance for each activityrather than only one activity base typically used in traditionalcosting. The variable manufacturing overhead variances for NoTuggins are presented in Exhibit 8-10 below.

And if you’re measuring how long it took you to complete Project XYZ, you could look at the number of hours it took each department compared with your predictions. A variance in accounting is the difference between a forecasted amount and the actual amount. Variances are common in budgeting, but you can have a variance in anything that you forecast. Basically, whenever you predict something, you’re bound to have either a favorable or unfavorable variance.

Posts relacionados