What Is the Accounting Equation Formula?

Let’s take a look at the formation of a company to illustrate how xero vs sage works in a business situation. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

Create a Free Account and Ask Any Financial Question

- Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses.

- The inventory (asset) of the business will increase by the $2,500 cost of the inventory and a trade payable (liability) will be recorded to represent the amount now owed to the supplier.

- Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting.

- It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business.

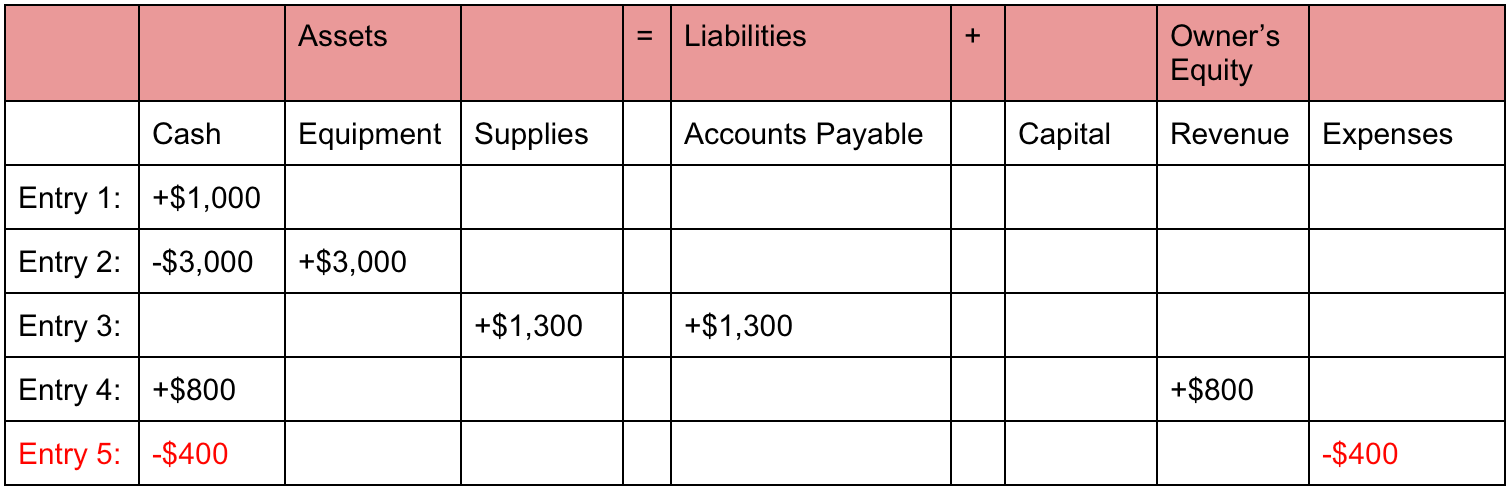

In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

Do you own a business?

On the other side of the equation, a liability (i.e., accounts payable) is created. Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. The company acquired printers, hence, an increase in assets. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250.

Arrangement #2: Net Value = Assets – Liabilities

Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity. Because it considers assets, liabilities, and equity (also known as shareholders’ equity or owner’s equity), this basic accounting equation is the basis of a business’s balance sheet. The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s).

The effects of changes in the items of the equation can be shown by the use of + or – signs placed against the affected items.

Investors are interested in a business’s cash flow compared to its liability, which reflects current debts and bills. Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future. As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded.

When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system. Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. Income and expenses relate to the entity’s financial performance.

Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market. The combined balance of liabilities and capital is also at $50,000.

Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. This arrangement can be ideal for sole proprietorships (usually unincorporated businesses owned by one person) in which there is no legal distinction between the owner and the business. For example, John Smith may own a landscaping company called John Smith’s Landscaping, where he performs most — if not all — the jobs. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background.

After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares. This business transaction increases company cash and increases equity by the same amount. As you can see, assets equal the sum of liabilities and owner’s equity. This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets. If the net amount is a negative amount, it is referred to as a net loss.

Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue. Assets entail probable future economic benefits to the owner. After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business.

Posts relacionados